Form HSMV 85008. International Fuel Tax Agreement, Florida Application - Florida

Form HSMV 85008 is utilized in Florida as an application for the International Fuel Tax Agreement (IFTA). This form is used by qualified motor carriers to apply for a fuel tax license and reporting credentials to simplify fuel tax reporting and payment across participating jurisdictions.

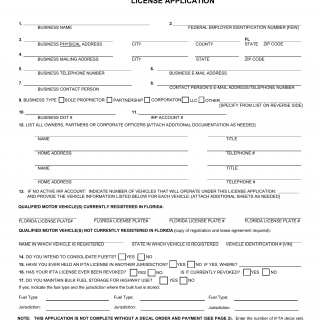

The form consists of sections and important fields, including:

- Carrier Information: This section requires details about the motor carrier, such as their legal name, address, contact information, identification numbers, and fleet information.

- Vehicle Information: Here, information about the vehicles operated by the motor carrier is provided, including the vehicle identification numbers, registered gross weights, and jurisdictions where the vehicles are expected to travel.

- Owner/Operator Information: If applicable, information about the owner/operators associated with the motor carrier can be included in this section.

- Signature and Certification: The authorized representative of the motor carrier must sign the form, certifying the accuracy of the information provided.

When completing this form, it is important to ensure that all required fields are accurately filled out. Providing correct information about the carrier, vehicles, and expected travel jurisdictions is crucial for obtaining the IFTA credentials. This form is used by motor carriers who operate qualifying vehicles in multiple jurisdictions and wish to streamline their fuel tax reporting and payment process.

An analogous form related to this is Form HSMV 85920, which is the International Registration Plan (IRP) Application - Florida. While Form HSMV 85008 pertains to the IFTA, Form HSMV 85920 is used to apply for the IRP, which allows motor carriers to register their vehicles for interstate operations under a single registration system.