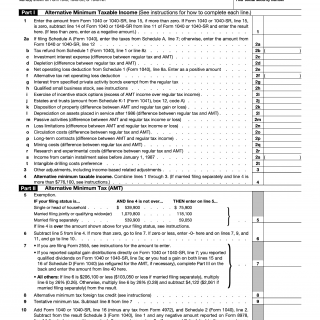

IRS Form 6251. Alternative Minimum Tax - Individuals

Form 6251, Alternative Minimum Tax - Individuals, is a document used by individuals to determine whether they owe alternative minimum tax (AMT) in addition to their regular income tax. The form consists of two pages and requires certain information to be provided in order to complete it accurately.

Important fields on the form include the taxpayer's name, Social Security number, filing status, and income information. The purpose of the form is to calculate the taxpayer's AMT liability, which is a separate tax system that operates alongside the regular income tax system. The AMT is intended to ensure that high-income taxpayers pay a minimum amount of tax, regardless of the deductions and credits they may be eligible for under the regular income tax system.

When completing the form, individuals will need to provide information about their income, deductions, and credits, as well as any other factors that may affect their AMT liability. This may include information about tax-exempt interest, incentive stock options, and certain deductions for state and local taxes. Individuals may also need to attach additional documents to the form, such as a copy of Form 1040, their regular income tax return.

One application example for Form 6251 is when an individual has a high income and/or a large number of deductions and credits that may trigger AMT liability. Another use case is when an individual has received incentive stock options from their employer and needs to calculate the AMT consequences of exercising those options.

One strength of the form is that it helps ensure that high-income taxpayers pay a minimum amount of tax, which can promote a more equitable tax system. However, a weakness of the form is that it can be complex and confusing for taxpayers to complete, particularly if they have a large number of deductions and credits.

Alternative forms that individuals may use include Form 1040, U.S. Individual Income Tax Return, which is used to report regular income tax liability, and Form 1040-ES, Estimated Tax for Individuals, which is used to pay estimated tax throughout the year.

Submitting Form 6251 is done by including it with the individual's regular income tax return, typically Form 1040. The form is stored by the IRS and can be accessed as needed in the future.

In summary, Form 6251 is a document used by individuals to determine whether they owe alternative minimum tax in addition to their regular income tax. It consists of two pages and requires certain important fields to be completed accurately. When completing the form, individuals will need to provide information about their income, deductions, and credits, as well as any other factors that may affect their AMT liability. The form can be complex and confusing, but helps ensure a more equitable tax system. The form is typically submitted with Form 1040 and is stored by the IRS for future access.