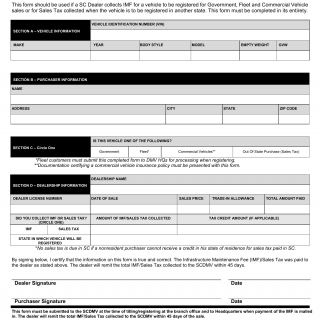

SCDMV Form TI-IMF. Notification of IMF Fees/Sales Tax Paid to SC Dealers

The SCDMV Form TI-IMF is used to notify the South Carolina Department of Motor Vehicles (SCDMV) of fees associated with an IMF (Infrastructure Maintenance Fee) and sales tax that have been paid to a licensed South Carolina dealer. The IMF fee is a charge imposed on vehicles to fund infrastructure maintenance in the state.

This form consists of sections where the dealer can provide their information, including name, address, and dealer number, as well as details about the transaction, such as the buyer's name and address, vehicle information (make, model, year, identification number), and the amount paid for the IMF fee and sales tax.

It is important for dealers to accurately complete and submit this form to the SCDMV to ensure proper record-keeping and payment of the IMF fee and sales tax. Failure to do so may result in penalties or legal consequences.

An example of a related form is SCDMV Form TI-010, which is a Dealer Title Application. This form is used by dealers to apply for a title for a vehicle they have sold. While both forms involve dealer transactions, Form TI-IMF specifically focuses on notifying the SCDMV about the payment of IMF fees and sales tax.