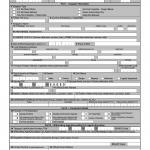

BIR Form 1904. Application for Registration For Taxpayer and Person Registering under E.O. 98 (Securing a TIN to be able to transact with any Government Office) and Others

BIR Form No. 1904, issued by the Bureau of Internal Revenue (BIR) in the Republic of the Philippines, is an essential document for individuals and entities seeking to register for a Taxpayer Identification Number (TIN) under various circumstances. This form facilitates the registration process and is crucial for compliance with tax and government regulations.